Keep up with the latest news and be part of our weekly giveaways and airtime sharing; follow our WhatsApp channel for more updates. Click to Follow us

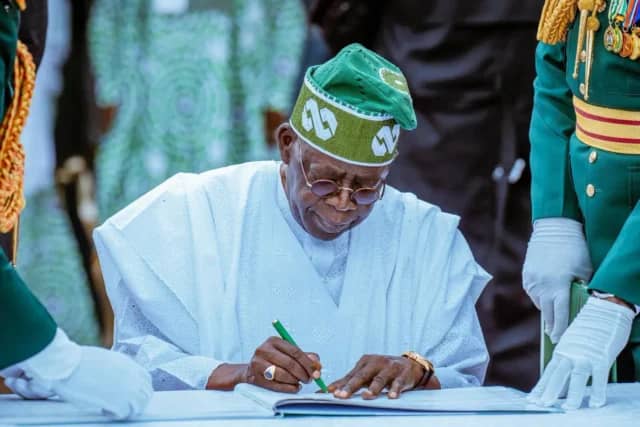

The Central Bank of Nigeria (CBN) has defended its decision to increase charges on cash withdrawals from other banks’ ATMs, saying it’s necessary to incentivise banks to improve access to cash. According to CBN Governor Olayemi Cardoso, “The banks are interested and need to be incentivised to ensure that there’s regular access for their ATMs so that people can come in, take money, and go out.”

The CBN has decided to retain the Monetary Policy Rate (MPR) at 27.5%, and Cardoso explained that this decision was unanimous among the Monetary Policy Committee (MPC). “The committee was unanimous in its decision to hold all parameters and thus decided as follows: retain the MPR at 27.50% and retain the asymmetric corridor around the MPR at plus 500 to minus 100 basis points,” he stated.

The new ATM charge, which costs N100 per N20,000 withdrawal, aims to encourage banks to increase cash availability at ATMs and make access to cash more seamless. Cardoso believes that this measure will not dissuade people from accessing their money but rather put banks under greater scrutiny, especially when it comes to withdrawal payments.

On a positive note, Cardoso mentioned that withdrawing from one’s own bank will not incur any charges. Additionally, customers can apply for a card from another bank they frequently use, which will also be free of charge.

The CBN governor also addressed concerns about balancing inflation-fighting efforts with the need for economic growth. He emphasised that achieving stability in the forex and financial markets is crucial for attracting foreign investment and enhancing economic growth. “Confidence is gradually returning to our markets, which shows that we are on the right course now,” Cardoso said.

Ultimately, the CBN aims to bring down the inflation rate to single digits in the medium to long term. Cardoso stated, “We will continue the orthodox monetary policies that we have embarked upon… We believe that inflation has been too high for too long. So our objective in the medium to long term is to ensure that we are able to bring this down from the double digits to the single digits.”

Cardoso also expressed optimism about the country’s economic prospects, citing the increasing competitiveness of the naira. “One other thing I will add to that is the fact that as of now, our currency is a lot more competitive. And with that competitiveness, we’ve seen an increasing interest from the international investors to want to come and invest in the country’s future,” he said.

The CBN governor emphasised the importance of stability in the foreign exchange and financial markets, noting that it is crucial for attracting foreign investment and enhancing economic growth. “Confidence is gradually returning to our markets, which shows that we are on the right course now,” he stated.

Cardoso also highlighted the need for vigilance in monitoring inflation, stating that the CBN will continue to implement orthodox monetary policies to achieve its objectives. “We will continue the orthodox monetary policies that we have embarked upon. We’ve seen the outcome, and it’s in a positive direction, and we will stay that course. We will certainly stay that course,” he said.

In conclusion, the CBN governor reiterated the bank’s commitment to achieving its objectives, including reducing inflation to single digits. “We believe that inflation has been too high for too long. So our objective in the medium to long term is to ensure that we are able to bring this down from the double digits to the single digits,” he said.

Please don’t forget to “Allow the notification” so you will be the first to get our gist when we publish it.

Drop your comment in the section below, and don’t forget to share the post.