Keep up with the latest news and be part of our weekly giveaways and airtime sharing; follow our WhatsApp channel for more updates. Click to Follow us

Cascador, a Lagos-based accelerator program for mid-stage Nigerian entrepreneurs, has awarded over $3 million in debt funding facilities to nine local startups to support their operations and reposition them for global competitiveness. The beneficiaries include Crop2Cash, Oriki, N.E.A.T., Adunni Organics, Sycamore, DoChase, Drive45, 24Seven, and ExCare, who received the funding at Cascador’s inaugural Pitch Day event in Lagos.

For further information, read more details here

Cascador CEO Trish Thomas stated that the funding is exclusively for graduates of the Cascador program, which has trained about 60 companies since its inception in 2019. “Our 2025 cohort will be our seventh. The funding is actually only available to alumni of the Cascador program. The nine finalists that you see today have been awarded over $3m in debt and equity capital,” she said.

Thomas explained that the funding is tailored to suit the specific needs of each business, many of which are in sectors such as manufacturing and agriculture. “We do not follow a traditional venture capital model. Some of them are looking at scaling up with sustainable growth, and what they need is working capital, not equity,” she added

About 74% of applicants opted for debt, leading to a partnership with Sterling Bank to offer favorable loan terms. “We are partnering with Sterling Bank. We are taking on the collateral requirements, pulling down interest rates, and breaking down lending barriers,” Thomas noted. The loans will attract interest rates of around 20%, with flexible features including moratoriums and repayment tenures of up to five years.

Founder of Cascador, Dave Delucia, emphasised that the program is not just about financing but includes mentorship and capacity-building to ensure the efficient use of capital. “The winners will have increased access to investors who can further support their business growth,” he added.

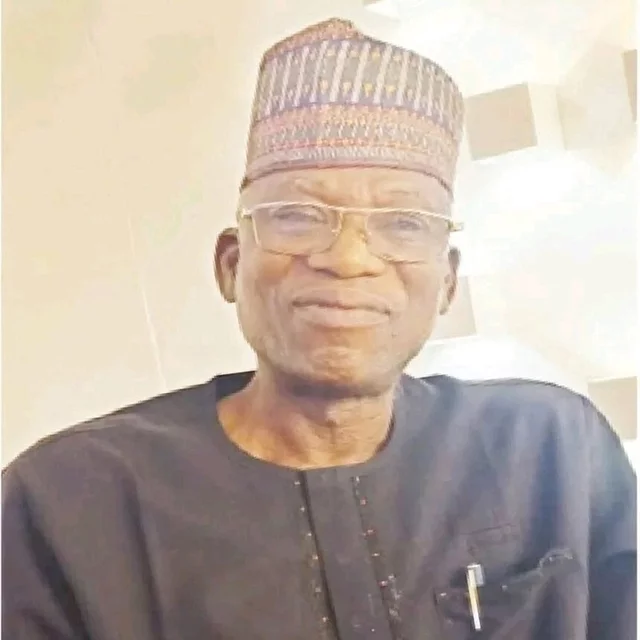

Sterling Bank’s managing director and CEO, Abubakar Suleiman, described the partnership as a means to help businesses become bankable and commercially viable. “Between that energy and becoming a successful business, there are a lot of ravines and obstacles. What capital tries to do is remove some of those obstacles,” he said.

Cascador has partnered with Sterling Bank to launch a $2 million Catalytic Fund aimed at unlocking growth for promising ventures across key sectors.

Please don’t forget to “Allow the notification” so you will be the first to get our gist when we publish it.

Drop your comment in the section below, and don’t forget to share the post