Keep up with the latest news and be part of our weekly giveaways and airtime sharing; follow our WhatsApp channel for more updates. Click to Follow us

The transaction costs for Automated Teller Machine (ATM) services have been reviewed by the Central Bank of Nigeria (CBN), and new rates will go into effect on March 1, 2025.

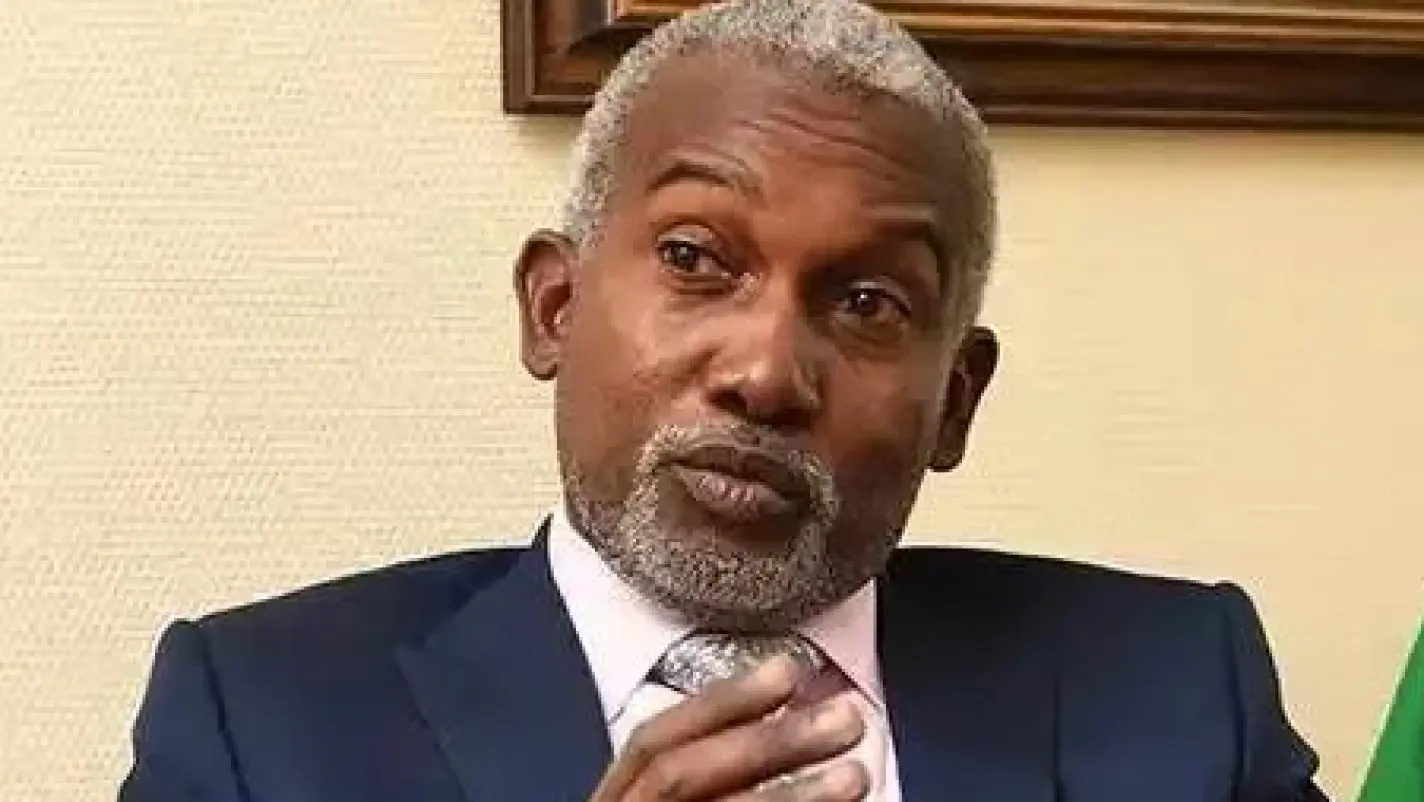

The CBN said the fee adjustment is intended to address the growing operational costs and improve efficiency in the banking industry in a circular signed by John Onojah, the acting head of the Financial Policy and Regulation Department.

The CBN lowered withdrawal costs from ₦65 to ₦35 in 2019, marking the most recent revision to ATM transaction prices.

The CBN stressed that the new policy is in line with Section 10.7 of the CBN Guide on Charges by Banks, Other Financial, and Non-Bank Financial Institutions (2020), even if it may result in higher prices for some ATM transactions.

Customers will continue to receive free withdrawals under the new arrangement when they use the ATMs operated by their own bank (on-us transactions). However, at the bank’s branches, there is a ₦100 fee for each ₦20,000 withdrawal made at on-site ATMs.

Customers who make off-site or non-on-us withdrawals at other banks’ ATMs will be assessed a fee of ₦100 in addition to a surcharge of up to ₦450 for every ₦20,000 withdrawal.

The CBN now permits banks and financial institutions to impose a “cost-recovery charge” equal to the precise amount charged by the foreign acquirer when making overseas withdrawals using debit or credit cards.

Furthermore, the three free monthly withdrawals that were previously offered to remote-on-us transactions (those made by customers of other banks) would no longer be available.

Prior to the new instructions’ implementation date, the CBN has asked all financial institutions to adhere to them, stressing that the updated costs are intended to increase the effectiveness of ATM services and guarantee that customers are charged the correct amount.

Please don’t forget to “Allow the notification” so you will be the first to get our gist when we publish it.

Drop your comment in the section below, and don’t forget to share the post.