Keep up with the latest news and be part of our weekly giveaways and airtime sharing; follow our WhatsApp channel for more updates. Click to Follow us

The Nigerian insurance industry is poised to undergo a significant transformation as it sets its sights on achieving a gross premium income of N5 trillion in the next five years. This ambitious target is a significant increase from the N1.17 trillion recorded in the third quarter of last year.

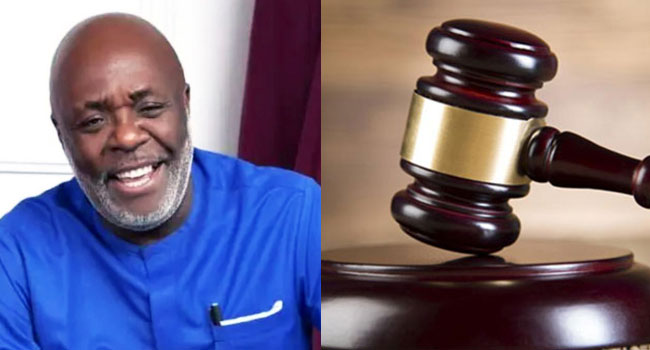

According to Kunle Ahmed, Chairman of the Nigerian Insurers Association (NIA), the industry has made significant progress in recent years, growing from N1 trillion to N1.17 trillion in just two years. However, Ahmed emphasized that to reach the N5 trillion mark, insurers must adopt a more innovative and customer-centric approach.

For further information, read more details here

“We can’t achieve this target by doing things the way we used to,” Ahmed said at the CEOs Retreat in Lagos. “We need to move faster and serve our customers in a more seamless manner. That’s where digitalisation comes in.”

Ahmed highlighted the importance of embracing digital disruption and social innovation in the insurance industry. “Digital disruption is a force that has already begun to transform the way we conduct business, communicate, and serve our customers,” he said. “We must proactively adapt and innovate to stay ahead of the curve.”

The NIA Chairman urged insurers to leverage technology to better understand and serve their customers, harness the power of data to drive decision-making and innovation, and create a seamless and integrated digital experience that exceeds customer expectations.

Ahmed also emphasized the role of social innovation in reshaping the insurance industry. “As insurers, we have a responsibility to address the evolving needs of our diverse communities and ensure that our services are inclusive, accessible, and beneficial to all,” he said.

The CEOs Retreat, themed “Digital disruption and social innovation: Reshaping our traditional models,” provided a platform for industry leaders to discuss the opportunities and challenges presented by digitalisation and social innovation.

As the insurance industry navigates this era of rapid technological advancements and evolving societal needs, Ahmed’s call to action is clear: “We must embrace digitalisation and social innovation to remain relevant and competitive and to create a brighter future for our customers and communities.

Please don’t forget to “Allow the notification” so you will be the first to get our gist when we publish it.

Drop your comment in the section below, and don’t forget to share the post.