Keep up with the latest news and be part of our weekly giveaways and airtime sharing; follow our WhatsApp channel for more updates. Click to Follow us

The Joint Tax Board (JTB) has assured Nigerians that they will not be barred from operating their bank accounts even after January 1, 2026, despite provisions in the newly signed Tax Acts suggesting otherwise.

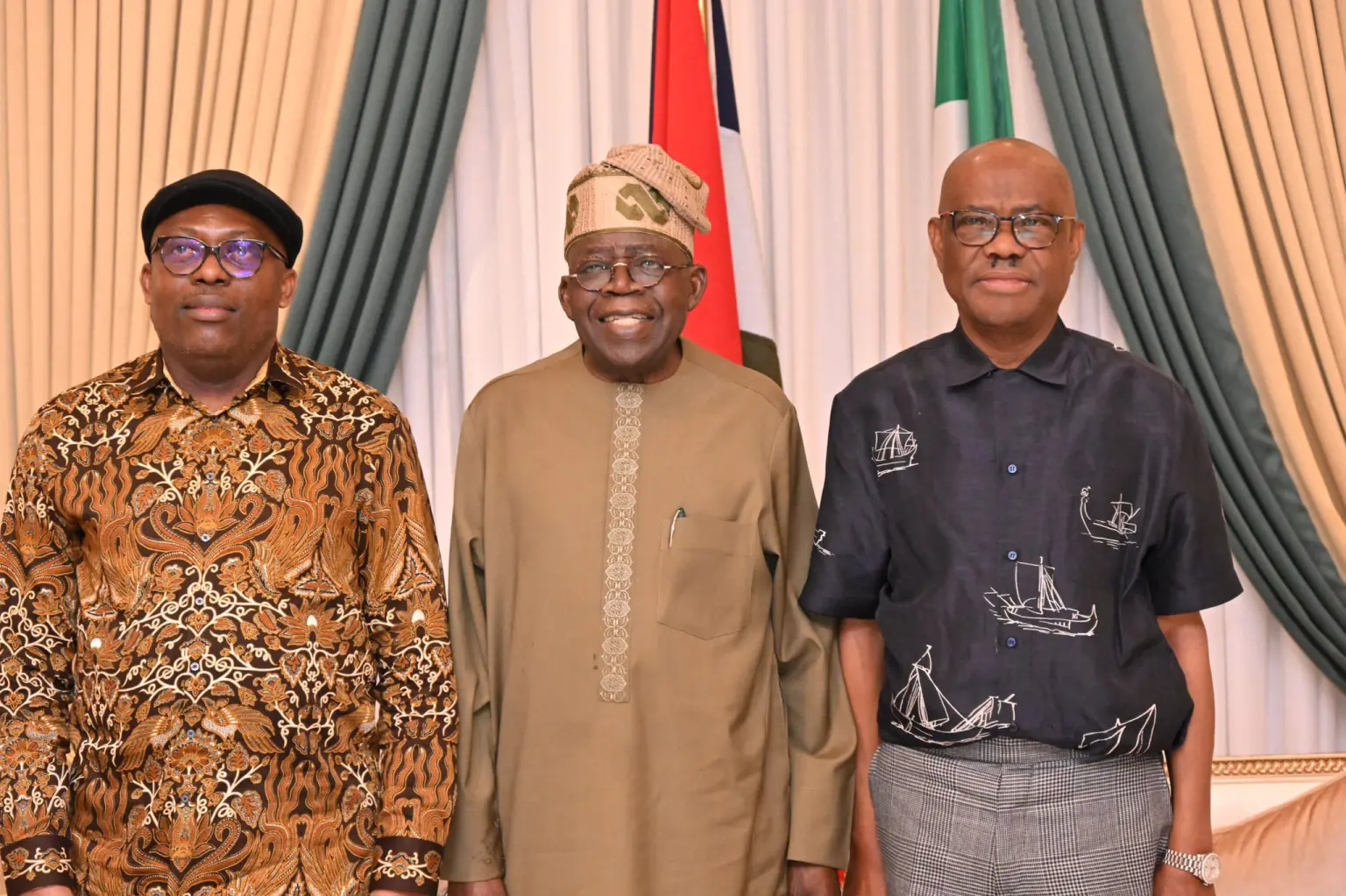

President Bola Tinubu recently assented to four new Tax Acts, set to take effect from January 1, 2026. Among them, the Tax Administration Act stipulates in Section 8 (2) that a Tax Identification Number (Tax ID) will be required for individuals to operate bank accounts or engage in insurance, stocks, and related financial services once the law becomes operational.

However, in a statement released in Abuja by Akpe Adoh, Head of Corporate Communications, the JTB dismissed fears that Nigerians without a Tax ID would lose access to their financial services.

“The attention of the Joint Tax Board (JTB) has been drawn to recent reports and insinuations suggesting that Nigerians without a Tax Identification (Tax ID) will be denied access to their bank accounts or prevented from carrying out financial transactions from January 1, 2026,” the statement read.

“Nigerians are hereby assured that they will continue to have access to their bank account and also continue to carry out financial transactions even beyond January 1, 2026.”

The JTB further explained that the ongoing tax reforms under President Tinubu are aimed at simplifying compliance and making the system fairer. “In line with the tax reforms championed by His Excellency, President Bola Ahmed Tinubu, Government is working to make tax compliance simpler, fairer, and more inclusive for all Nigerians. These reforms include eliminating multiple taxation, granting tax exemptions to vulnerable individuals and small businesses, and ensuring that the majority of Nigerians will pay lower taxes under the new tax regime.”

Highlighting measures to ease compliance, the JTB noted that it is working closely with the Federal Inland Revenue Service (FIRS) and state tax agencies on a harmonised National Tax Identification system. According to the statement:

“This system will leverage the National Identification Number (NIN) for individuals and the Registration Number (RC) for businesses as unique identifiers for tax purposes.

“This initiative will enable the seamless and automatic generation of tax IDs for individuals with NIN and businesses with RC thereby making it easier for Nigerians to comply with tax requirements without any disruption to their banking and/or financial activities.

The JTB urged Nigerians not to panic. “We therefore urge the public to remain calm and ignore any claims to the contrary. Again we restate for the avoidance of doubt that Nigerians will continue to have access to their bank accounts and carry out financial services beyond January 1, 2026, and no one will be denied access on account of not having a Tax ID.”

Reaffirming its commitment, the board added: “The JTB remains committed to implementing people-centred tax policies that promote economic growth, fairness, and ease of doing business while ensuring that Nigeria remains a tax friendly environment.”

The clarification comes amid concerns over provisions in the law, including the controversial 5 percent Petroleum Products Tax, which has already drawn criticism. The Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, last week reassured Nigerians that there was “no immediate plan” to implement the petroleum tax

Please don’t forget to “Allow the notification” so you will be the first to get our gist when we publish it.

Drop your comment in the section below, and don’t forget to share the post