Keep up with the latest news and be part of our weekly giveaways and airtime sharing; follow our WhatsApp channel for more updates. Click to Follow us

The naira experienced a mixed performance across various segments in the past week, reflecting the Central Bank’s ongoing efforts to stabilise the currency. Analysts noted that forex market interventions from the CBN have slowed down amidst a decline in external reserves, which stood at $39.09bn as of Thursday.

At the parallel market, the naira strengthened to about 1,552/$ from 1,660 in the previous week, driven by improved investor confidence. In contrast, the naira faced ongoing demand pressure at the official Nigerian foreign exchange market, depreciating by 0.54% week-on-week to 1509.70/$ from 1,501.61/$.

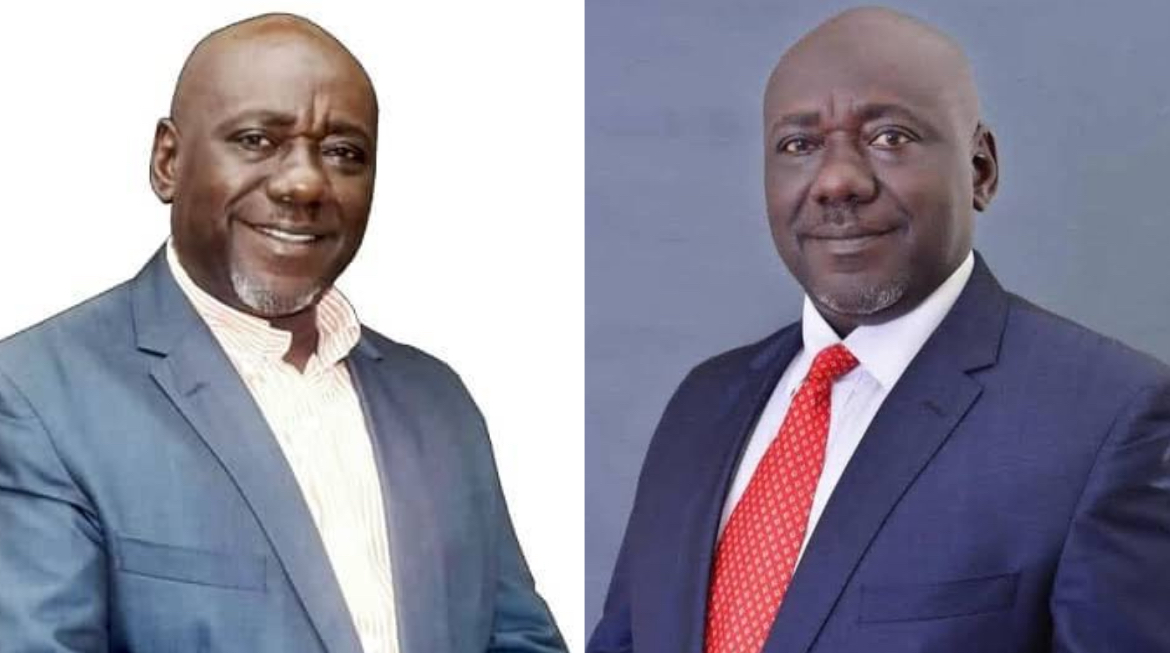

Aminu Gwadebe, President of the Association of Bureau De Change Operators, expressed optimism about the appreciation of the naira. “The performance of the naira was significantly positive. Naira performed positively throughout the past week from about 1660; we are now talking about 1552/$. That is significant,” he said.

Gwadebe attributed the appreciation to a combination of factors, including the pick-up of interbank proceeds to Bureaux de Change, the Chinese holiday reducing demand, and improved investor confidence. “The market, especially the interbank, is awash with portfolio inflows. Also, there is no negative perception,” he noted.

Analysts at Cowry Assets Management Limited project that the naira will trade within a relatively stable range in the coming week, “provided there are no significant market distortions.” They emphasised that market dynamics will continue to shape the supply and demand for the dollar, influencing the local currency’s performance.

The naira’s appreciation is attributed to the clearance of the $7bn foreign exchange backlog and improved liquidity in the market. Governor of the Central Bank of Nigeria, Olayemi Cardoso, announced that the Federal Government had cleared the backlog, ensuring that businesses and investors can repatriate funds seamlessly.

However, investment company Comercio Partners projects that the naira will drop to about 1,700/$ at half-year, citing Nigeria’s reliance on oil imports and limited capacity to generate sustainable dollar inflows. They emphasise that a holistic, coordinated effort between monetary and fiscal authorities is necessary to ensure sustained currency appreciation and broader economic resilience.

Comercio Partners stated, “Nigeria’s reliance on fuel imports has remained one of the primary drivers of dollar demand, placing persistent pressure on the naira. The economy’s limited capacity to generate sustainable dollar inflows through exports further exacerbates currency instability.”

They also noted, “While Eurobond issuances provide temporary relief to Nigeria’s exchange rate challenges, their impact is fleeting in the absence of structural economic reforms. The CBN’s interventions, including EFEMS and rate adjustments, demonstrate the potential for short-term stabilisation but fall short of addressing the naira’s underlying vulnerabilities.”

Looking ahead, Comercio Partners projected, “As Nigeria moves into 2025, the combination of reduced fuel imports, improved investor confidence, and high-yield investment opportunities creates a pathway for stability. We project that the naira will close the first half of 2025 (at) N1,700-N1800 per dollar.”

Governor of the Central Bank of Nigeria, Olayemi Cardoso, expressed optimism about the clearance of the $7bn foreign exchange backlog, saying, “In addressing foreign exchange liquidity constraints, decisive steps have been taken to clear the outstanding $7bn forex backlog to ensure that businesses, multinationals, corporations, and foreign investors can repatriate funds seamlessly.”

Aminu Gwadebe, President of the Association of Bureau De Change Operators, also commended the CBN’s efforts, saying, “The CBN has resolved to engage with stakeholders and work with them. They are doing a lot of forward guidance so that they can communicate with investors, operators, and other stakeholders. I think that approach has been giving a lot of people hope.

Please don’t forget to “allow the notification” so you will be the first to get our gist when we publish it.

Drop your comment in the section below, and don’t forget to share the post.